What Are Stocks and How Do I Buy Them?

Welcome to Stocks 101.

This article is a brief introduction to stock market investing and some of the main concepts you should understand before you become an investor.

On this blog I talk a lot about the stock market, so it’s only right that I answer the most frequently asked questions I get about becoming an investor all in one place.

Hopefully, this article will expand your financial IQ and help you gain the confidence you need to get in The Game.

If you learn anything at all from this article please share it with someone who is walking with you on the path to financial success.

*IMPORTANT: I am not your financial advisor, financial planner, or accountant. I am a blogger. This blog is strictly for entertainment purposes and should not be taken as professional advice.

Cool.

Here we go.

A Little Bit Of Everything You Need To Know Before You Invest In The Stock Market

What Is a Stock?

Stocks are one of many different types of financial instruments that are used to move capital (money) throughout the economy.

As a group, these financial instruments are called ”Securities”.

These are four of the most common types of securities;

Stocks

Bonds

Mutual Funds

ETFs

Stocks are more formally known as “Equity Securities” because stocks represent a very small equity share in the ownership of a company.

For that same reason, when you purchase stocks it is said that you are purchasing “Shares”.

Owning shares makes you a “Shareholder”.

So, when you buy a stock you literally become a partial owner of that company.

How Do You Make Money In The Stock Market?

As a shareholder, you can build wealth two ways;

Capital Appreciation

Dividends

Capital Appreciation

This occurs when the “Market Value” of the stocks you own increases over time. Market value is the most current price of a stock.

However, no profit actually hits your pocket until you sell your shares.

Once you sell your shares, any profit you’ve made on top of your initial purchase price is called a “Capital Gain”.

Before you celebrate your win, I’ve got good news and bad news.

Bad News - The government wants their cut of any profit being made in their country.

Good News - When it comes to capital gains the government actually give you a break!

In Canada and the USA, capital gains are taxed more favourably than earned income from your day job.

Translation: If you make the same amount of money working a job vs investing, after taxes you will keep more of the money you make from investing.

Better News - If you want to avoid capital gains all together, you can trade stocks inside of your Tax-Free Savings Account (pretty sure they call the TFSA a “Roth” account in the USA).

Inside the TFSA you can enjoy all the capital appreciation and dividends you can get. Just make sure you don’t exceed your TFSA contribution limit… But that’s a conversation for another blog.

Dividends

When businesses make money they usually reinvest some of their profit to help the company grow.

They can open new locations, hire more staff, or increase their research and development budget.

Once a mature company reaches a certain size, they actually begin to have so much money that the best use of it is to give some back to shareholders.

🤷🏾♂️ Go figure.

As a shareholder, the dividends you receive are essentially your cut of the profits.

Not all stocks come with dividends, though. Usually, only massive, well developed companies with stable profits offer dividends.

If you want to know what the dividend that you can expect to get from a particular stock is, look for its “Dividend Yield”.

The yield is percentage relative to the market value of the stock.

For example, a stock that is trading at $100 with a dividend yield of 5% will pay out $5 each year.

For a in-depth discussion on dividends, Motley Fool has a great article and video which explain more.

When I Buy Stocks, Does The Company I’m Buying Get Paid?

No.

The only time that a company makes money from the purchase of their equity securities is when the securities are are first issued leading up to their Initial Public Offering.

Before the IPO, an investment dealer (a big investment company) will determine what the new issues of stock should be worth when they are released. Then, the dealer will agree to buy the new stocks from the company having the IPO at a set price. This process is called “Underwriting”.

This is when companies actually make a profit from selling shares.

Then, the investment dealer turns around and sells those new shares (for a profit) to the general public on the stock market.

What Exactly Is The Stock Market?

The stock market is a centralized (not necessarily physical) location where investors and brokers make offers to sell and bids to buy securities.

When a seller’s “Offer” (asking price) matches the “Bid” (most someone is willing to pay) of a buying investor - Ta-Da! - a trade is executed.

The “Stock Market” that you and I buy equity securities on is actually made up of many different stock exchanges.

The most popular stock exchanges that you hear about day-to-day are the “TSX” (Toronto Stock Exchange), “NASDAQ” (National Association of Securities Dealers Automated Quotations System), and “NYSE” (New York Stock Exchange).

How Do You Know What Stocks To Buy?

I can’t tell you what stocks to buy or how to pick them.

That’s up to you and your investment advisor (if you have one).

How you choose to invest your money is going to depend on a variety of factors, primarily;

Your investing goals.

Your time horizon (how long are you trying to be invested for before you need your money back).

Your risk tolerance.

How much capital you have to invest.

You other sources of income.

Making a quick flip and doubling your money in the stock market is not as easy as it looks on TV. Picking stocks that dramatically increase in value over a short period of time is extremely difficult.

Even professional traders who spend countless hours studying the markets often pick losers.

There is always a risk of losing some or all of your investment when you are buying stocks.

So, instead of trying to pick individual winners one-by-one you can always just buy ETFs.

What Is an ETF?

An “Exchange-Traded Fund” is a hybrid type of security.

This can get super nerdy and complicated, but I’ll keep it as simple as possible.

ETFs trade on the stock market like regular stocks. However, when you buy an ETF you don’t just get one company, you get many different companies all at once.

ETFs package together many different securities from entire indexes or specific industries.

For example, you can buy a Canadian tech company ETF, a short-term bond ETF, Gold ETFs, solar energy ETFs, or you can buy every stock in on the market with a total stock market index ETF.

This video by TD Ameritrade does a solid job of explaining what ETFs are and how you can make them a part of your investment strategy.

As you can see, there are a lot of options.

Let’s look at an example of a popular ETF.

Ticker symbol VOO is an ETF created by Vanguard that aims to replicate the performance of the S&P 500 Index by holding each of the top 500(ish) stocks in the USA.

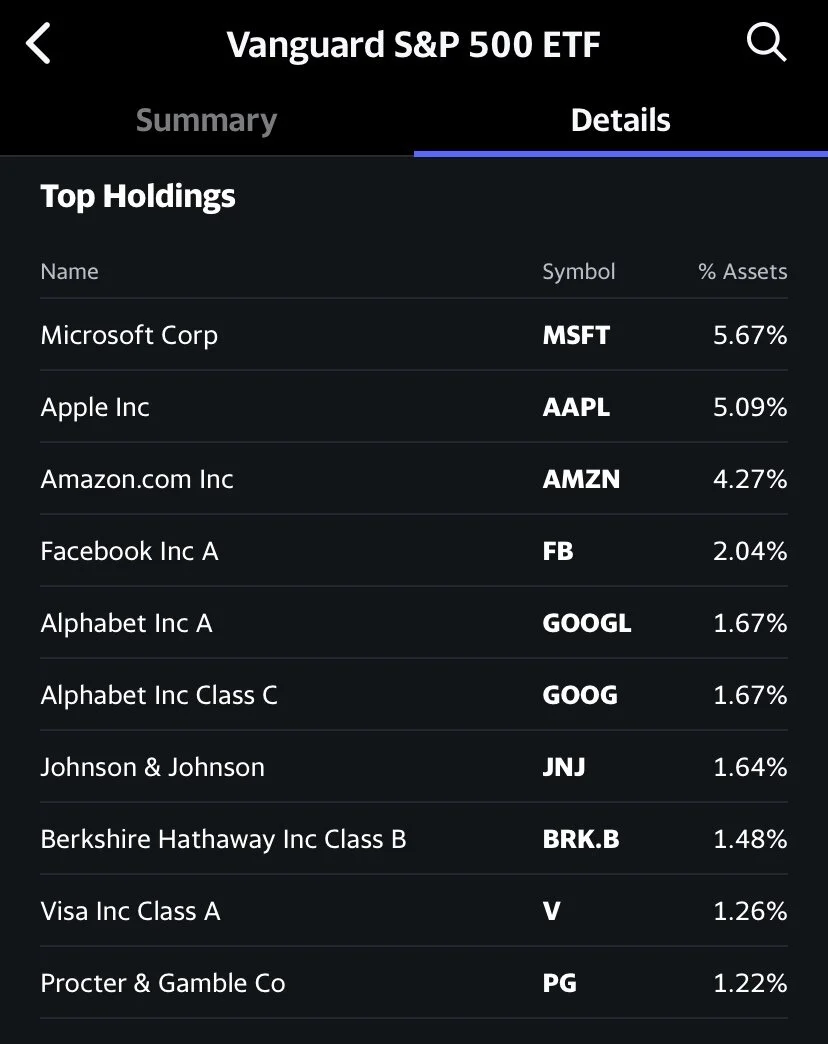

Figure 1 is a list of VOO’s top 10 holdings as of June 2020;

Fig. 1 - VOO is an ETF by Vanguard which aims to match the S&P 500 Index by holding all of the stocks in the S&P 500.

Here is a list of all 509 stocks in VOO… (Yeah, The S&P 500 isn’t actually 500 stocks - Go figure 🤷🏾♂️)

Because ETFs can hold many different stocks all in one, they can offer built-in diversification.

Diversification generally helps to reduce risk.

So, if one day Apple somehow goes bankrupt and falls out of the top 500 companies in the USA, the value of VOO will not go to zero along with it. Instead, another new company will be introduced into the top 500 and the index will continue to identify and hold only the top (as measured by size) stocks in the country.

In other words - you can lose some money investing in an Index ETF, but you can’t lose ALL of your money.

Less risk at the cost of average returns.

If you’re in it for the long run, these are a great place to start doing your research.

Does It Cost Money To Buy Stocks and ETFs?

Back in the day, you needed to have a stock broker if you wanted to get into the stock market. In 2020, that is no longer true.

Traditionally, a broker or investment advisor would help clients pick appropriate securities to invest in based on their goals and risk tolerance. This broker took time to get to know the client, so that they could offer the best recommendations for the client’s specific situation.

In return for their time and effort the broker would get a commission.

Now, you can bypass investment advisors - and their commissions - by picking stocks for yourself!

How? Discount Brokerages.

Where Can I Buy My Own Stocks?

“Discount Brokerages” are investment dealers who allow clients to save money by picking and managing their own investments.

Also, most discount brokerages are completely online. Meaning they don’t have the same overhead costs built into their business as big banks do.

This allows them to offer their services at a cheaper rate for you, the investor. Nonetheless, these brokerages have investment advisors available upon request for an additional fee, if you really want some help.

In fact, some discount brokerages also offer pre-made portfolios for investors who want a “set it and forget it” investing experience.

People usually refer to these ready-made portfolio companies as “Robo-Advisors” because they use computers to pick your asset allocation and to keep your portfolio balanced.

You can register with a discount brokerage and be trading in as little as 3 days. Account setup is a matter of minutes, but it usually takes a few days for your money to transfer into your new account.

How Much Money Do You Need To Start Investing?

In most situation, it takes money to make money.

For a long time, you needed huge minimum balances to even get in the game.

Personally, I’ve tried RBC Direct Investing and Questrade, but Wealthsimple Trade is definitely the best for new investors.

Why?

Let me share my experience.

RBC Direct Investing was where I started because I have an account with RBC…. Ooops 😒

RBC was charging me $9.95 per trade, buy or sell!

Additionally, if I had less than $1,000 in my account I was charged $25 every three months just to maintain my account.

Then I switched to Questrade.

While Questrade allows you to buy ETFs for free, selling ETFs (or buying/selling individual stocks) is going to cost you between $4.95 to $9.95 per transaction.

When you are just starting out with a small portfolio, $5 can be a lot.

$5 is 10% on a $50 trade.

In other words, you would have to make a 10% gain before breaking even just to overcome the commissions you pay to get in the game!

This is a huge barrier to people who want to get into the market, but don’t have a lot of money yet.

Questrade also requires a $1,000 minimum to start an account which isn’t within reach for everyone.

No bueno.

Then, I found the sweet spot.

Wealthsimple, on the other hand, is designed to make trading easy and accessible for everyone.

Sign up is free.

Unlimited trading is free.

Account minimums - None.

And quite honestly, their mobile app has the BEST user experience of the three, hands down.

You can open a RRSP, TFSA, or a taxable trading account in minutes.

It’s pretty amazing.

What Is The Best Discount Brokerage For New Investors In Canada?

If you’re just starting out, the best app on the market for buying stocks and ETFs is Wealthsimple Trade.

They makes it easy to get started with as little as $1.

Yup.

That’s it.

So, with free sign up, no account minimums, and no commissions on trades - There is literally no one on the market that can compete.

If you’re ready to start trading use my referral link below and get a $5 welcome bonus once you trade $100 bucks.

Start Trading: Open a Free Trading Account with Wealthsimple!

Hope this helps!

If you have any other questions, leave them in the comments and I’ll keep this post updated with new answers.